Lock In Your Lowest Life Insurance Rate

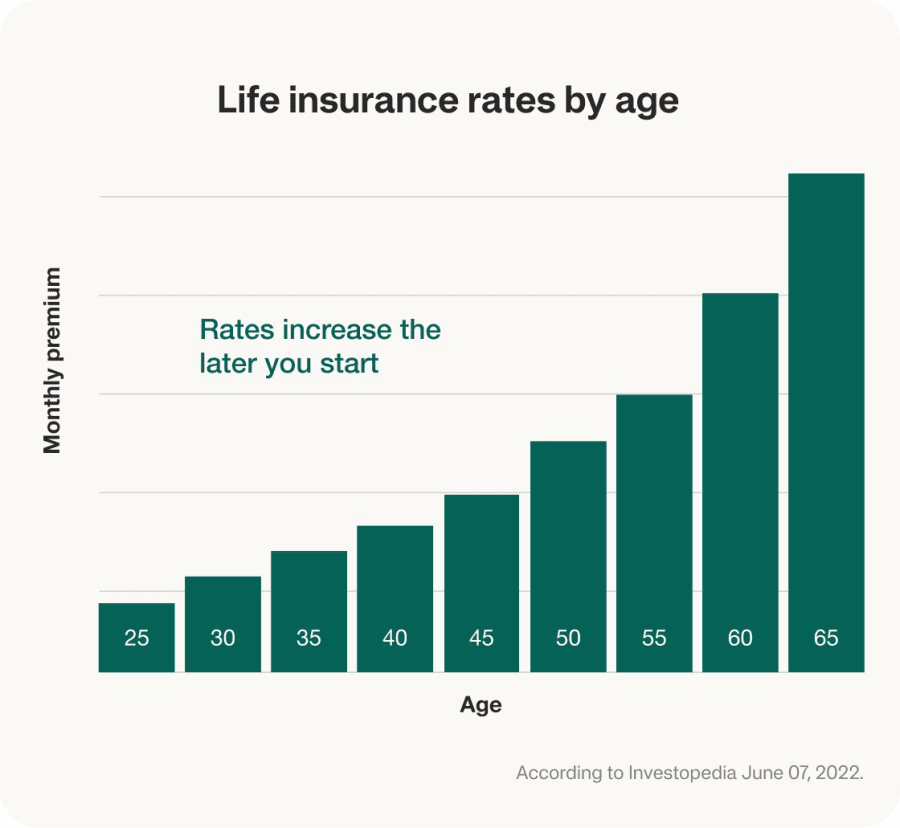

Life insurance premiums typically rise with age, so the earlier you buy, the more you can save. Securing a policy now means locking in the lowest possible rate—helping you protect your loved ones while saving money over time.

A Simple Way to Save on Life Insurance

One of the easiest ways to lower your life insurance costs is to get covered early. According to Investopedia, life insurance premiums typically increase every year you delay purchasing a policy. However, once your policy is active, your rate is locked in for the entire term—it won’t go up as you age or if your health changes.

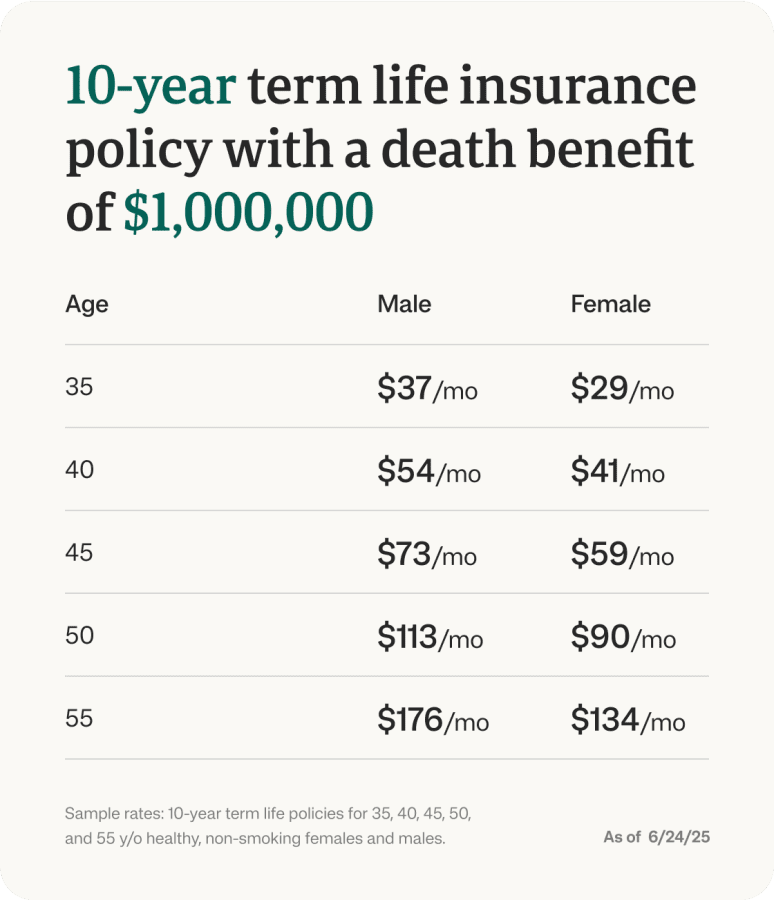

For example, in 2025, a healthy 40-year-old non-smoking man could get a 10-year term policy with $1 million in coverage for around $54/month. If he waits until age 45, that same policy could cost him $73/month. Acting sooner not only gives you peace of mind—it also saves you money.

How does Life Insurance Network work?

Average Term Life Insurance Rates by Age

Life insurance premiums tend to rise as you get older. Based on Life Insurance Network’s data, we created a term life insurance rate chart to illustrate how monthly costs increase across different age groups. These quotes are based on a 10-year term policy with a $1 million death benefit for applicants in good health.

For example, a 35-year-old male might pay around $37 per month for coverage. That same policy for a 45-year-old could cost $73 per month. By locking in coverage at 35 instead of waiting until 45, you could save more than $430 annually over the life of the policy.

While it’s still possible to get term coverage later in life, keep in mind that rates for seniors are significantly higher. Even so, term life insurance generally remains more affordable than permanent life insurance for older adults, since it provides coverage for a set period and doesn’t include a cash value component.

Why Term Life Insurance Rates Are Lower for Younger People

Term life insurance is typically more affordable for younger individuals, mainly because they present a lower risk to insurers. Younger people are generally healthier and less likely to face serious medical issues, which means the likelihood of an insurer needing to pay out a claim during the policy term is lower.

While it may seem like age-based pricing, it’s actually rooted in data. Insurance companies rely on actuarial tables—statistical tools that predict life expectancy based on age and health. These models consistently show that younger people have lower mortality rates, which is why insurers offer them lower premiums. Simply put, buying life insurance early can save you a significant amount over time.

A+ Rated and Backed by Trusted Insurance Providers

Life Insurance Network partners with some of the most respected and highly rated insurance companies in the industry—giving you confidence that your coverage is reliable and secure. We put your needs first, and our outstanding customer reviews reflect that commitment.

Common mistakes when buying life insurance

Waiting Until You Have Kids

With more people choosing to start families later in life, many delay purchasing life insurance until they have children. But waiting can mean missing out on locking in lower rates while you’re younger and likely healthier. Even if you don’t yet have kids, life insurance can still protect your partner or loved ones by covering personal debts, medical bills, mortgage payments, lost income, or funeral expenses. And when you do have children, your policy will already be in place to safeguard their future.

Assuming You'll Stay Healthy

Your current health is a major factor in determining your life insurance rate. The better your health, the more affordable your premiums. While it’s easy to assume you’ll remain healthy for years to come, health conditions like diabetes or cancer can develop unexpectedly—especially as you get older. These changes can increase your costs or make getting coverage harder altogether. Buying life insurance while you’re young and healthy helps secure your financial protection before health issues arise.

Relying on Employer-Sponsored Coverage

While life insurance through your employer is a helpful benefit, it’s often not enough to fully protect your loved ones. Most employer-sponsored policies only cover one to two times your annual salary, far below the 10 times coverage amount that many financial experts recommend.

Another important consideration is that your coverage is tied to your job. If you retire, change jobs, or get laid off, you could lose that coverage entirely. And if that happens later in life—or after a health issue develops—it may be more costly or harder to qualify for new coverage. Having your own life insurance policy ensures continuous protection for you and your family, no matter how your employment status changes.

How to get the best term life insurance rates

You’ve seen how life insurance rates can rise significantly with age—but while you can’t control how old you are, there are several steps you can take to help lower your term life insurance costs.

Maintain Good Health:

Your overall health plays a major role in determining your premiums. The healthier you are, the better your chances of qualifying for lower rates. If you have existing health conditions, making lifestyle changes—such as improving your diet, exercising, and managing chronic issues—can help improve your eligibility and pricing.

Choose the Right Coverage and Term Length:

Carefully consider how much coverage you actually need and select a term length that aligns with your financial responsibilities. This ensures you’re not paying for more coverage than necessary, which can help keep your premium lower.

Quit Smoking:

Smoking is one of the costliest habits when it comes to life insurance. Smokers often pay significantly higher premiums due to the health risks associated with tobacco use. If you quit and remain smoke-free for a certain period, many insurers will reclassify you and offer reduced rates.

By taking steps to stay healthy and choosing the right policy, you can secure the protection your loved ones need—without overpaying.

How does Life Insurance Network work?

How Life Insurance Network Works

Choose Your Coverage

Apply in Minutes

Once you’ve selected your plan, fill out our quick online application. Just answer a few questions about your age, health, medical history, and lifestyle. It’s simple, secure, and can take as little as 10 minutes.

Get Coverage

After submitting your application, we’ll review it in real-time—many applicants receive an instant decision. Once approved, you can activate your coverage right away. No medical exam is required—your answers to the health questions are all we need.

FAQs

Can I Save by Getting Life Insurance Early?

Yes—buying life insurance earlier in life can lead to significant savings. As you age, your risk factors increase, which typically means higher premiums. Getting covered sooner allows you to:

- Lock in a lower rate while you’re young and healthy

- Gain peace of mind knowing your loved ones will be financially protected

Is Life Insurance More Expensive If I Smoke?

Yes, smoking typically leads to higher life insurance premiums. Because smoking increases the risk of serious health issues, insurers charge more to offset that risk. Your rate is also influenced by other factors, such as:

- Your age

- Smoking status

- Existing health conditions

Quitting smoking and maintaining good health can help lower your premium over time.

Can I Get a Good Term Life Insurance Rate If I Wait Until I’m Older?

While it’s true that life insurance premiums generally increase with age, it’s still possible to find an affordable term life policy later in life. The key is choosing a provider that:

- Understands your unique needs

- Helps guide you to the right coverage

- Offers flexible options that fit your budget

Life Insurance Network is here to do exactly that—helping you secure the right policy at any stage of life.

Can I Still Find a Policy If I Have Health Conditions?

Yes, having health conditions doesn’t mean you can’t get life insurance. While it may affect your premium, there are still affordable options available. In many cases, adjusting your coverage amount or term length can help reduce the cost.

Here are a few key things to keep in mind:

- Smokers and those with certain health issues may pay higher premiums

- There are policies designed to accommodate a wide range of health conditions

- It’s never too late to explore your term life insurance options

No matter your health status, you can still find coverage that fits your needs and helps protect your loved ones.

See what our customers are saying

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end, I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind that my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end, I was given options that exceeded my expectations and gave me peace of mind that my wife is in good hands if something happened to me.