What Is Accidental Death Insurance?

Discover how accidental death insurance might be right for you—with guaranteed coverage and rates starting at just $8/month.*

Accidental death overview

What Is Accidental Death Insurance?

Accidental death insurance is a type of policy that pays a cash benefit to your beneficiaries if you die in a covered accident. This coverage is guaranteed and offers financial protection for your loved ones in the event of an unexpected loss.

Why Consider Accidental Death Coverage?

Accidental death insurance may be a good option if:

You want a simple application process with no medical exam or health questions

You’re looking for extra coverage to supplement your existing life insurance

You haven’t qualified for traditional life insurance but still want some protection

You engage in a high-risk job or hobby where accidental death is a concern

How Much Coverage Can I Get?

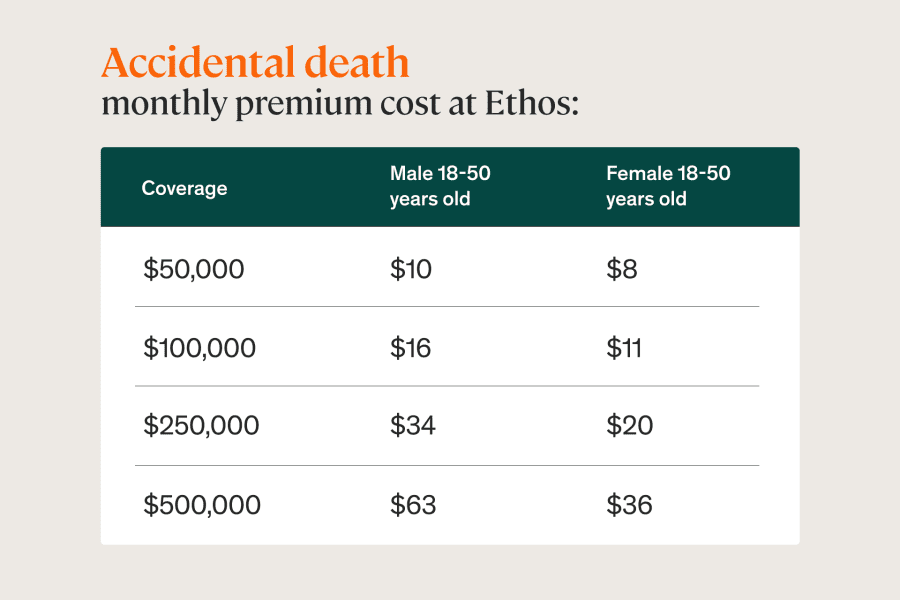

Accidental death coverage typically starts at $50,000 and can go up to $500,000. You can adjust your policy amount in $1,000 increments to match your needs. Your monthly premium is based on factors like your age, gender, and the coverage amount you choose. Once your policy is active, your rate is locked in and won’t increase—as long as you continue paying your premiums.

When selecting a coverage amount, think about your current savings, mortgage, and any outstanding debts that could impact your loved ones financially if something were to happen to you.

Cost of Accidental Death Insurance by Age

Accidental death insurance is available to individuals aged 18 to 70, with coverage amounts up to $500,000. Your premium is based on the coverage amount you select—the higher the coverage, the higher the premium. Policies can be customized in $1,000 increments to match your specific needs and budget.

Note: The rates shown apply to individuals aged 18–50. Rates for ages 51–70 are available upon request.

How does Life Insurance Network work?

Mistakes to Avoid When Choosing Coverage

Waiting Until You Have Kids

Accidental death insurance isn’t just for parents. Even if you don’t have children, it can help cover personal debts, medical bills, mortgage payments, lost income, and funeral costs—offering valuable protection for those you leave behind.

Relying on Employer-Sponsored Coverage

While accidental death coverage through your employer is a helpful benefit, it’s often not enough. These policies typically offer limited coverage and may end if you retire, change jobs, or are laid off. Owning a personal policy ensures continuous protection for you and your loved ones—no matter where life takes you.

A+ Rated and Backed by Top Carriers

Life Insurance Network partners with some of the world’s most trusted and highly rated insurance carriers, so you can feel confident in your coverage. Our commitment to putting customers first is reflected in our strong reputation and excellent user reviews.

FAQs

What Does Accidental Death (AD) Insurance Cover?

Accidental death insurance provides a payout if the insured dies as a result of a covered injury, whether the incident is work-related or not. Life Insurance Network’s accidental death policies also include added benefits if the death occurs while the insured is a fare-paying passenger on a common carrier—such as a plane, bus, or boat—or while driving, riding in, or being struck by a motor vehicle.

How Is Accidental Death Insurance Different from Life Insurance?

Life insurance typically provides coverage for death due to any cause while the policy is active. In contrast, accidental death (AD) insurance only pays out if the insured dies as a result of a covered accident. AD coverage is guaranteed for individuals aged 18 to 70 and offers significantly lower premiums per dollar of coverage compared to traditional life insurance.

What Is Not Covered by Accidental Death (AD) Insurance?

Generally, accidental death insurance does not cover deaths caused by illness or any pre-existing physical or mental health conditions.

Can I Cancel My Accidental Death Insurance Policy?

Yes, you can cancel your accidental death insurance policy at any time—there’s no penalty for doing so.

See what our customers are saying

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end, I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind that my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end, I was given options that exceeded my expectations and gave me peace of mind that my wife is in good hands if something happened to me.