Life Insurance for Parents: What You Should Know

Life Insurance Network was created to provide a better, easier experience for people applying for life insurance. With billions in coverage issued, we’re delivering on that promise. We follow strict privacy standards and partner with some of the most trusted insurance providers in the industry—so you can feel confident your policy is reliable and secure.

How Much Does It Cost to Raise a Child?

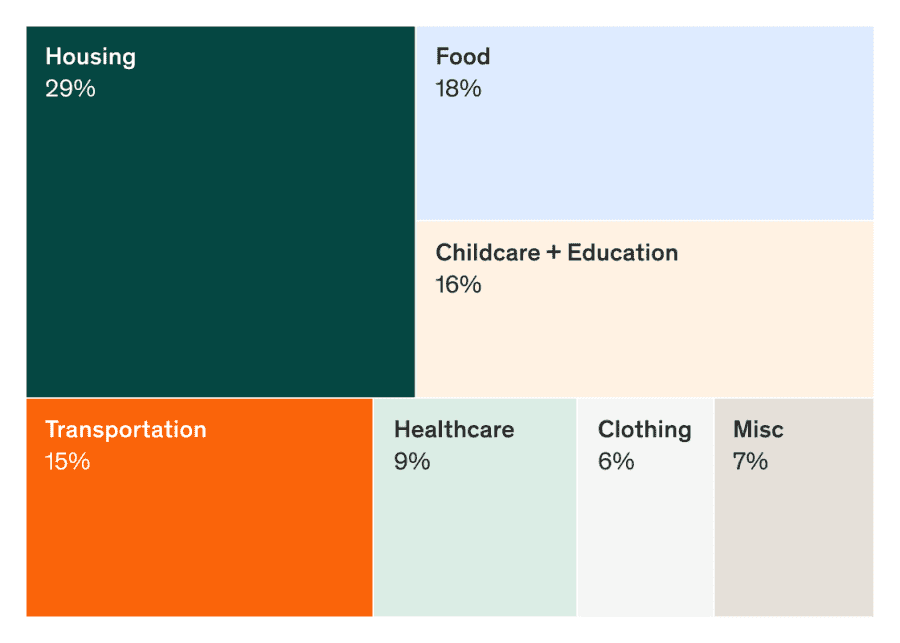

Raising a child isn’t cheap. From diapers to diplomas, the costs add up quickly. According to a 2022 Brookings study, a middle-income family in the U.S. can expect to spend about $311,000 to raise a child through age 18. This includes expenses like housing, childcare, food, clothing, and everyday necessities.

And that’s just up to age 18—college is another major financial hurdle. Tuition fees continue to rise each year. A recent U.S. News & World Report study shows that average tuition and fees have increased by 144% at private colleges and 211% at public universities. Even with financial aid, many families struggle to cover the full cost.

Whether you’re already a parent or planning to become one, it’s essential to understand the long-term financial commitment of raising children. Life insurance can help ensure your family has the financial support they need if you’re no longer there to provide for them.

Is Life Insurance Really Necessary?

If you’re a parent, life insurance isn’t just a nice-to-have—it’s a critical part of protecting your family’s future. Start by understanding your coverage options and choosing a policy that fits your family’s needs. Financial experts typically suggest selecting a coverage amount that reflects the number of years your loved ones might need financial support if something were to happen to you.

Already have a policy? That’s a smart move. But as your family grows or your finances change, it’s important to review your coverage and make sure it’s still enough.

Life insurance isn’t just another financial product—it’s a key piece of your long-term planning, helping to provide peace of mind and financial stability for the people who matter most.

Questions Parents Commonly Have

It is too early to buy life insurance?

Do stay-at-home parents need life insurance?

Even if you’re not earning a salary, you should still consider carrying life insurance. Consider all the value you provide to your family as a stay-at-home parent. More than half of all families using childcare spend over $10k per year. And if a stay-at-home parent made an annual salary, it would equate to around $178k, according to Salary.com.

Never underestimate your value as a stay-at-home parent. Having a life insurance policy is just one more way you can contribute to your family’s financial well-being when it’s needed most.

Who should I name as a beneficiary?

Your beneficiary is the person, persons, or designated trust that receive your life insurance policy proceeds if you die while your policy is active. As the policy owner, you select your primary beneficiary (or beneficiaries) when you fill out your application.

If you’re a parent, the primary beneficiary is typically your spouse, life partner, or children. Your life insurance benefit could help offset your income, pay off outstanding debt, cover education costs, and alleviate your loved ones’ everyday living expenses for years to come.

What's the best life insurance for new parents?

Every family’s needs are different. There are two primary types of life insurance: whole life and term life.

Whole life insurance is permanent and remains in effect for the insured’s lifetime, as long as the premium gets paid. Term life insurance provides coverage for a specific period. Life Insurance Network offers term lengths between 10 and 30 years and coverage options from $20,000 to $2 million. With term life, you pay a fixed premium for the duration of the policy, so your rate never increases.

To choose the best plan for your family, consider your current financial situation. Suppose you’re a new parent and want a 30-year term life policy that provides coverage until your child reaches adulthood. If your kids are in college, you might only want a 10-year term to cover educational expenses and any other unexpected situations if you pass away before they finish school.

New parents looking for life insurance often choose term life insurance because the monthly premiums can be a fraction of the cost of a whole life policy. Term life may be a good life insurance policy for new parents since it provides coverage for the years you need it most and won’t cost you when you no longer need it.

How Much Life Insurance Do New Parents Need—and What Will It Cost?

Buying life insurance isn’t just about replacing your income—it’s about protecting your family from financial hardship if the unexpected happens. If you were to pass away, your loved ones could be left with major financial responsibilities, such as a mortgage, business obligations, or cosigned debts.

A common guideline is to aim for coverage that equals around 10 times your annual income. On top of that, consider adding the total of any outstanding debts, projected college tuition, childcare, household expenses, and general cost of living. It’s also wise to include extra coverage to help support your spouse’s income for a year or two, giving them time to grieve without rushing back to work. If your spouse is a stay-at-home parent, think about what it would cost if they suddenly needed to work and pay for full-time care.

To better understand your needs and explore policy costs, you can use the Life Insurance Network life insurance calculator—it’s a helpful tool to estimate how much coverage makes sense for your family and budget.

How Much Life Insurance Do New Parents Need—and What Will It Cost?

There’s no single formula when it comes to buying life insurance, especially for growing families. Your needs will depend on a range of factors, including your mortgage, existing debts, everyday living costs, and future expenses like college tuition.

For most parents, the goal is simple: to provide lasting financial security for your loved ones in case something happens to you. Consider what your family would face financially if you were no longer around—your income, your debts, and the cost of maintaining their lifestyle.

So how do you figure out how much coverage is enough? A common rule of thumb is to multiply your annual income by 10. Then add in additional financial needs: your mortgage balance, outstanding loans, estimated education expenses, childcare, and daily household costs. If your spouse works, you may want extra coverage to give them time off without worrying about income. If they’re a stay-at-home parent, estimate what it would cost if they needed to return to work and arrange care for your children.

To get a clearer picture, try the Life Insurance Network life insurance calculator—it can help you estimate how much coverage you need and what it might cost monthly.