Own a Home? You May Want Life Insurance

Owning a home is often the biggest financial commitment a person makes, and it comes with long-term responsibilities. If you’re the primary earner and pass away unexpectedly, your partner or co-signers may be left struggling to cover the mortgage. Life insurance can help ease that burden by providing funds to pay off the mortgage and cover other debts or living expenses, offering your loved ones financial stability during a difficult time.

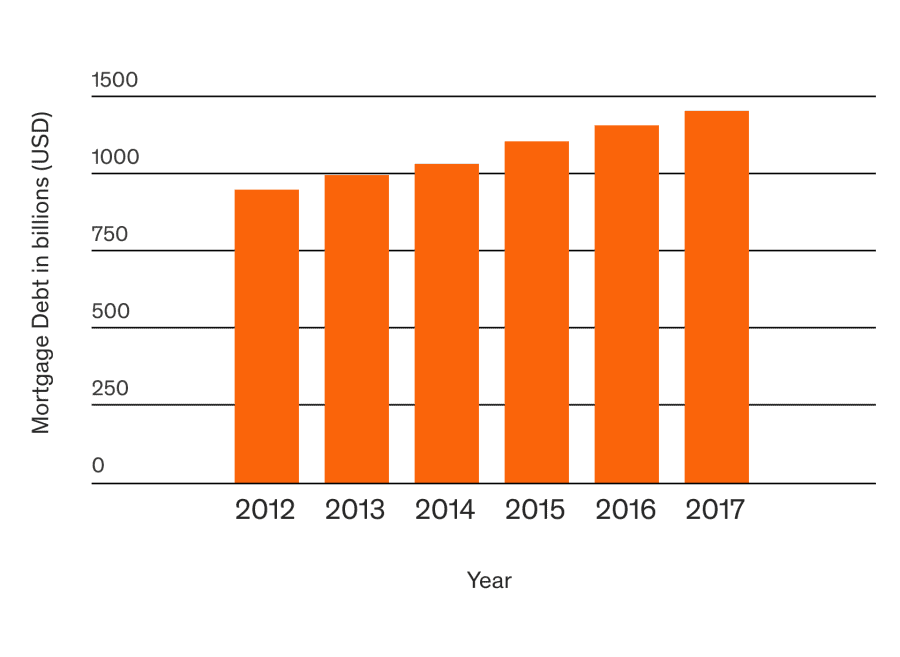

Mortgage Debt Is Steadily on the Rise

Data from the U.S. Census Bureau shows that more than 62% of U.S. homeowners have a mortgage. In 2021, the average mortgage for a new home exceeded $410,000, while the average balance across all mortgages was over $215,000—often even higher for younger homeowners. As mortgage debt continues to grow nationwide, so does the potential financial burden on loved ones if something were to happen to you. The more debt you carry, the more important it becomes to have life insurance in place to help protect those you leave behind.

What Are Your Coverage Options?

Mortgage Protection Life Insurance (MPI)

Mortgage protection life insurance is often offered by lenders as part of the home-buying process. It’s designed to pay off your remaining mortgage balance if you pass away while the policy is in effect, with the payout going directly to the lender—not your family. As you pay down your mortgage, the coverage amount decreases alongside the loan balance.

While Life Insurance Network doesn’t offer mortgage protection life insurance specifically, any life insurance policy purchased through Life Insurance Network can still help cover your mortgage. The death benefit goes directly to your chosen beneficiary, who can use the funds however they see fit—including paying off the home.

Pros

- No medical exam required

- Most applicants qualify

Cons

- Payout amount decreases over time, but premiums stay the same

- Benefit is paid to the lender, not your family

- Covers only your mortgage, not other expenses

- Often more expensive than term life insurance

Term Life Insurance

Term life insurance offers greater flexibility than mortgage protection insurance. With this option, you choose your beneficiary, coverage amount, and policy term length. It provides protection for a set period—typically 10, 20, or 30 years—and ensures your loved ones are covered during that time. In addition to mortgage payments, term life insurance can help cover a wide range of expenses, such as outstanding debt, lost income, college tuition, medical bills, and everyday living costs.

Pros

- Can be used to cover all life expenses (up to your coverage limit during the policy term)

- Your beneficiary receives the benefit directly

- Rates are personalized based on your health and financial needs

- Payout amount stays the same while the coverage is active

Cons

- A medical exam may be required (though Life Insurance Network uses a health questionnaire and typically does not require an exam)

- Not all applicants may qualify

MPI vs. Term Life Insurance: A Quick Comparison

Mortgage Protection Life Insurance

- Coverage Amount: Decreases over time as your mortgage is paid down

- Coverage Length: Matches the term of your mortgage

- Beneficiary: Your mortgage lender

- Purpose of Coverage: Pays off the remaining mortgage balance

Term Life Insurance

- Coverage Amount: Life Insurance Network policies range from $20,000 up to $2 million

- Coverage Length: 10 to 30 years

- Beneficiary: Chosen by you

- Purpose of Coverage: Can be used for any needs your beneficiary decides—mortgage, debts, living expenses, and more