Boost your savings with life insurance

A savings account or life insurance can help safeguard your family’s future if something unexpected happens. But when planning ahead, which should you prioritize? The truth is—you need both.

Why Life Insurance Matters

Before choosing a policy, it’s important to understand how life insurance works. A life insurance policy is a contract between you and your insurer that promises a death benefit to your chosen beneficiaries if you pass away while the policy is in effect.

Beneficiaries are the individuals or organizations you designate to receive this financial payout—known as the death benefit—should you die during the policy term.

Life insurance typically falls into two main categories:

Whole life insurance: This permanent coverage lasts your entire lifetime, as long as premiums are paid. It features fixed premiums and usually includes a cash value component that grows over time, in addition to the guaranteed death benefit.

Term life insurance: This coverage lasts for a set period—typically 10 to 30 years—offering protection when you need it most. At Life Insurance Network, you can choose term life insurance with coverage ranging from $20,000 to $2 million. Once the term ends, renewal may be possible depending on the policy.

Choosing a life insurance policy over a savings account

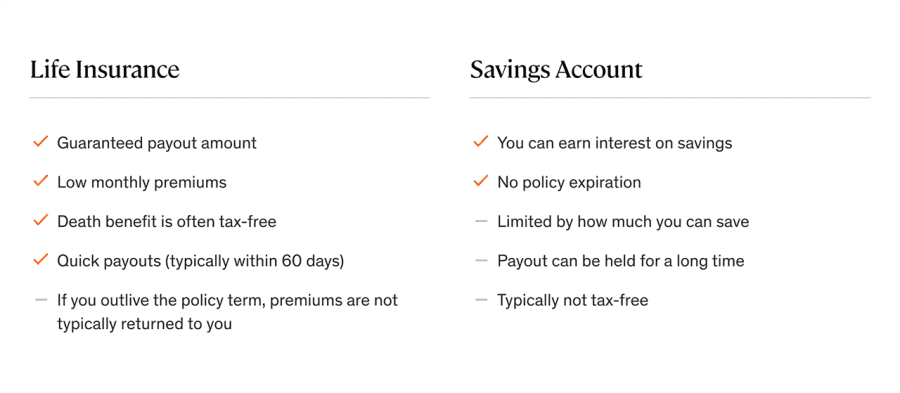

Life Insurance vs. savings: Pros and cons

Most savings accounts are considered liquid, allowing you to access your funds at any time. In contrast, a certificate of deposit (CD) typically locks in your money for a set period, though early access is possible—often with a penalty.

Why You Need Both Life Insurance and Savings

Savings alone may not be enough

If you pass away unexpectedly, one of the first expenses your loved ones may face is your funeral—which can cost nearly $8,000 in the U.S. Meanwhile, over half of Americans report having less than $3,000 in savings, and the average household carries more than $5,000 in credit card debt. It’s easy to see how quickly savings could run out. A life insurance policy can help fill that gap, providing critical financial support for funeral costs, mortgage payments, lost income, and daily living expenses.

Getting to Know the Cash Value of Life Insurance

As you explore different types of online life insurance, you’ll discover that certain whole life policies include a cash value feature that grows over time with interest. In some cases, you can borrow from or withdraw this cash value, giving you added financial flexibility when needed.

What Happens If You Outlive Your Term Life Policy?

Term life insurance is designed to protect you during your peak earning years. By the time your policy ends, you may have paid off debts and built up savings to support your retirement. That’s why having both life insurance and a solid savings plan is essential—they work together, not in place of each other. With a strong financial foundation in place, your family’s future won’t rely solely on your life insurance coverage.

How Much Does Life Insurance Cost?

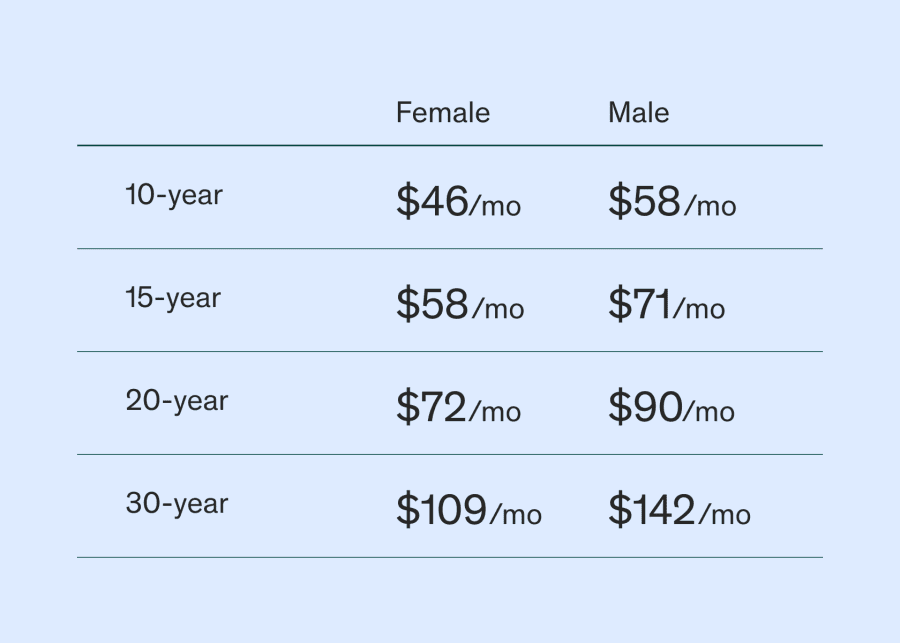

Term life insurance is one of the most affordable types of coverage available. Your monthly premium will depend on several factors, including your age, gender, health, family medical history, smoking status, occupation, and lifestyle. As long as you continue to pay your premiums, your policy stays active. If you pass away while covered, your beneficiaries will receive a guaranteed, typically tax-free lump-sum payment—usually within 30 to 60 days.

Here are example term life insurance quotes for $1 million in coverage for healthy, non-smoking men and women in their 30s.

How does Life Insurance Network work?

How do I apply online for affordable life insurance?

As you explore different types of online life insurance, you’ll discover that certain whole life policies include a cash value feature that grows over time with interest. In some cases, you can borrow from or withdraw this cash value, giving you added financial flexibility when needed.