Life Insurance for Women: Our Guide

Life insurance is an essential part of any woman’s financial strategy. Get the information you need from Life Insurance Network to make the right choice for your future.

The Changing Face of Life Insurance for Women

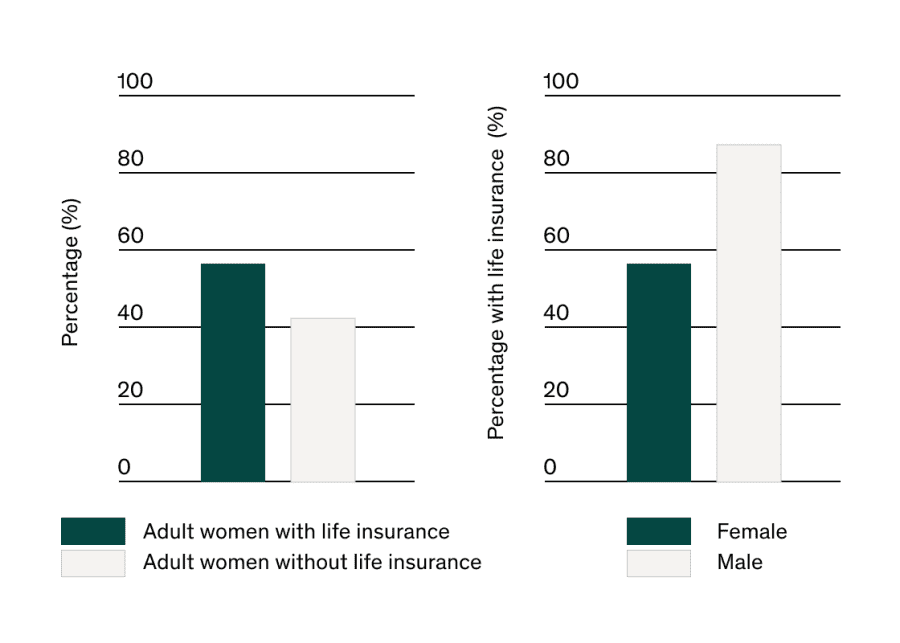

Nearly half of adult women in the U.S. have no life insurance at all, and many who do are significantly underinsured. Despite making up 57% of the American workforce, women typically hold 31% less life insurance coverage than men—leaving a major gap in financial protection.

How does Life Insurance Network work?

Life insurance is for women, too

When it comes to life insurance, women are often underrepresented. According to research from the Life Insurance Marketing and Research Association (LIMRA), only 47% of women in the U.S. have an active life insurance policy. And for those who do, the coverage amounts are generally much lower than those held by men—even though their financial responsibilities and protection needs are often the same.

How Life Insurance Protects a Woman’s Family

Life insurance offers vital protection for your loved ones. If you pass away while your policy is active, your chosen beneficiaries receive a financial death benefit to help cover expenses and maintain stability. That alone is a powerful reason for women to explore their life insurance options and secure their family’s future.

Three facts women need to know about life insurance

Understanding the basics of life insurance can help you choose the right coverage to meet your needs and safeguard your family’s future. Here are three key things to keep in mind:

Life Insurance Is More Affordable for Women

Women generally have longer life expectancies than men, which often translates to lower life insurance premiums. That means women typically pay less for the same amount of coverage—making it a smart and cost-effective way to protect their loved ones. It’s true: women can secure more coverage for less.

Term Policies Are Flexible

Term life insurance is a simple, affordable option—especially if you apply while you’re young and healthy. You pay a fixed monthly premium for a specific period, usually 10, 20, or 30 years. If you pass away during that term, your chosen beneficiaries receive a death benefit to help cover expenses and provide financial stability.

It’s Not Just for Parents and Breadwinners

Women make invaluable contributions both in the workplace and at home, yet they remain underinsured—not just in how many have life insurance, but also in how much coverage they carry. Regardless of job title or family role, life insurance is an essential tool for protecting the people who depend on you.

The Case for Coverage

Women play a central role in both earning and managing household finances, often serving as primary caregivers for children and aging parents. For single mothers, every responsibility—financial and otherwise—rests solely on their shoulders.

Despite the tremendous value of their contributions, this work is often undervalued, especially in households with stay-at-home moms. While they may not bring in a paycheck, the services they provide—childcare, organization, emotional support—are essential. Without proper life insurance coverage, their absence can leave a serious financial gap, making coverage all the more important for protecting the well-being of those they care for most.

A recent study found that if you translated the work, skills, and hours a stay-at-home mom dedicates into a salary, it would amount to roughly $185,000 a year. From project management to caregiving, the value she provides is significant—and another strong reason why life insurance is just as important for non-working spouses.

More Women Are Choosing Life Insurance Every Day

It’s essential for women to recognize the value of life insurance—no matter their role. Whether you’re a stay-at-home mom, a single parent, or the primary provider for yourself or your family, life insurance offers vital protection for your loved ones. It’s a smart step toward securing their future and your peace of mind.

| Term Length | $250k | $500k | $750k | $1 million |

|---|---|---|---|---|

| 10 years | $11/mo | $15/mo | $19/mo | $23/mo |

| 15 years | $12/mo | $17/mo | $23/mo | $28/mo |

| 20 years | $14/mo | $21/mo | $29/mo | $36/mo |

| 30 years | $24/mo | $30/mo | $42/mo | $54/mo |

Rates may vary based on individual factors.

All women need life insurance

Working Women

Even if your employer offers life insurance, it’s often not enough to fully protect your family. Most workplace policies cover only one to two times your annual salary, while experts typically recommend coverage equal to about 10 times your income. Another important factor to consider: employer-sponsored life insurance usually doesn’t follow you if you change jobs or become unemployed.

Having your own term life insurance policy ensures that you’re covered no matter where your career takes you—helping your loved ones stay financially secure in any situation.

Stay-at-Home Moms or Spouses

If you’re a stay-at-home parent or spouse, your contributions to the household are incredibly valuable—childcare, home management, and emotional support are all roles that would be costly to replace. While you may not earn a paycheck, your absence would still have a significant financial impact on your family. Life insurance can help cover those costs, ensuring that your loved ones are supported even if you’re no longer there.

Single Moms

Single mothers bear the full responsibility of providing for and caring for their children. That makes life insurance especially important—particularly if your children are still young and financially dependent. A term life insurance policy can offer peace of mind, knowing your kids would have financial protection if something were to happen to you.

Family Caregivers

Many women find themselves in the “sandwich generation,” caring for both children and aging parents. Whether you’re helping with medical bills or offering direct care, your contribution holds major financial value. If you’re no longer there to support them, your absence could create both emotional and financial strain. Life insurance helps ensure your family is still cared for and supported.

Single Women

Life insurance isn’t just for those with spouses or children. Even single women often have financial obligations—such as debts, funeral expenses, or caregiving responsibilities for a parent or sibling. A life insurance policy can help prevent those costs from falling on loved ones. And if you need to make changes after a divorce, Life Insurance Network can guide you through updating your policy.

See what our customers are saying

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end, I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind that my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end, I was given options that exceeded my expectations and gave me peace of mind that my wife is in good hands if something happened to me.