The Complete Guide to Life Insurance

Interested in life insurance but don’t know where to start? Find out what you need to know.

Do I need life insurance?

70% of American families would be bankrupt in months if they lost a primary breadwinner.

If something happens to you during your prime earning years, your loved ones don’t just lose you—they also lose the financial future you’ve been building. If you have a partner, children, or elderly parents who depend on you for support (financial or otherwise), then life insurance can be a great way to secure their financial future by providing them with a safety net should the unexpected happen.

Even if you have employer-sponsored life insurance, you may want to consider additional coverage for your family. Personal finance experts recommend that you have savings or coverage that is at least 10x your annual salary. Employer-sponsored policies typically only cover 1-2x your salary while you are employed full-time, and this coverage generally ends once you leave the company.

Having life insurance can ensure that your family’s future is safe, no matter what.

What type of insurance is best for me?

Term life insurance is the most simple and affordable option. It provides coverage for a set period of time or “term” (typically 10–30 years), and is designed to protect your dependents. If you pass away during the term period, your beneficiaries receive a cash payment to cover expenses or income loss related to your passing.

Permanent life insurance is more complex and costly (typically costing 10–20x more than term life for the same amount of coverage). It provides coverage in a set amount for your entire life and is sometimes used as an investment vehicle. Some insurers invest your premium payments and the interest earned on those investments goes back into your policy as accrued cash value. Please note: When choosing this type of policy, you should be prepared to assume meaningful levels of risk.

Life Insurance Network offers term life insurance policies because term insurance can be a better financial choice for many families. Particularly if:

- You need to replace your income over a specified period of time (for example raising children or paying off a mortgage).

- You want the most affordable coverage.

- You want a more streamlined and straightforward process.

For people aged 60+ who want to protect their loved ones from financial burden after their passing, Life Insurance Network offers guaranteed issue whole life policies. Guaranteed issue whole life insurance are right for you if:

- You have previously been declined for life insurance

- You thought you could not get life insurance due to your age or health

- You don’t want your family to have to worry about your final expenses

Life insurance

How much coverage do I need?

Debt + Income + Mortgage + Education = Total Coverage Amount

Buying life insurance can seem overwhelming, especially when it comes to figuring out how much coverage you need to protect your loved ones. However, calculating how much life insurance you should buy is fairly straightforward.

Many experts recommend buying a life insurance plan that covers 10x your income. You can also calculate your life insurance number using the DIME method.

Debt

Income

Mortgage

Education

Consider this:

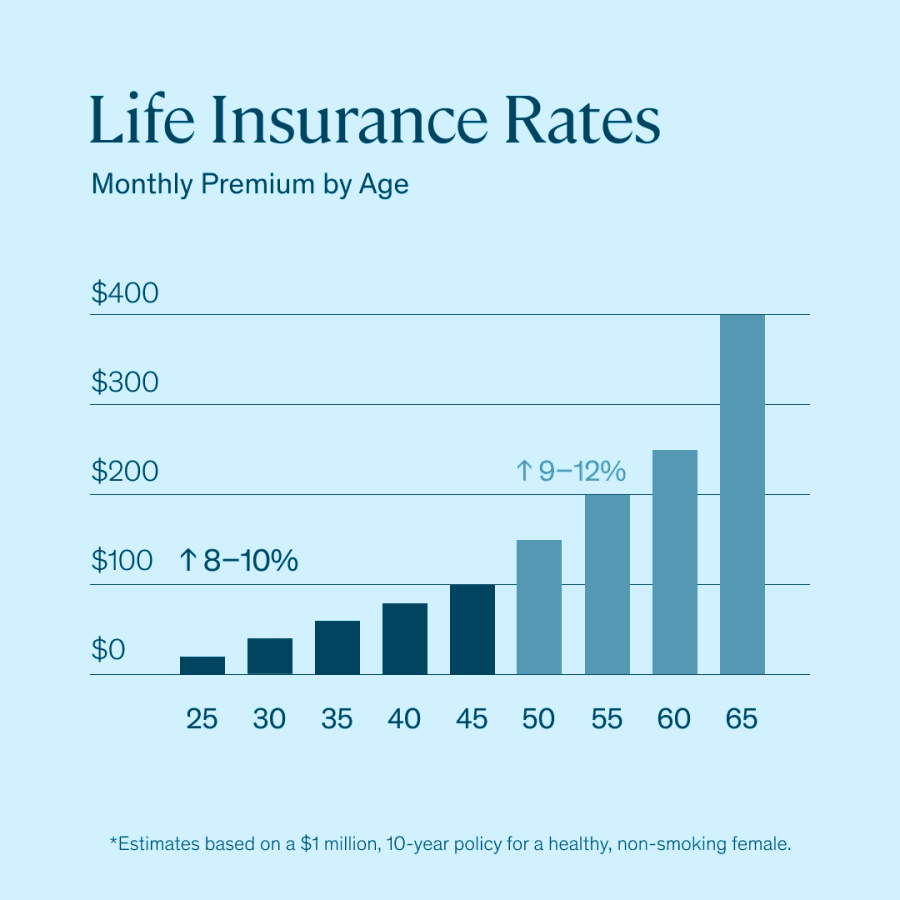

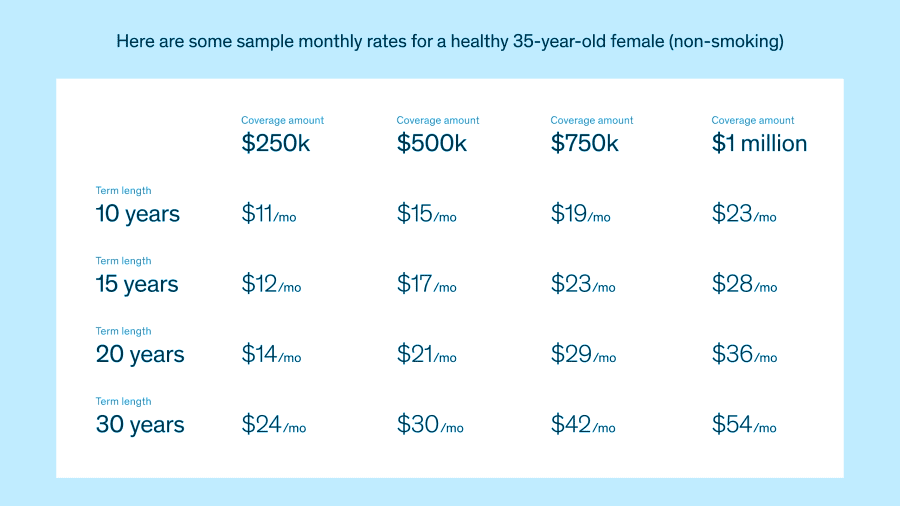

If term insurance is right for you, and you’re young and healthy, we recommend choosing a term life insurance policy with a longer term. Rates increase as you age, so in the long term it can benefit you to lock down a lower rate now and avoid higher rates if you renew your policy at the end of your term. Although your policy premium might be slightly higher now, you’ll have better coverage and won’t incur steep increase later.

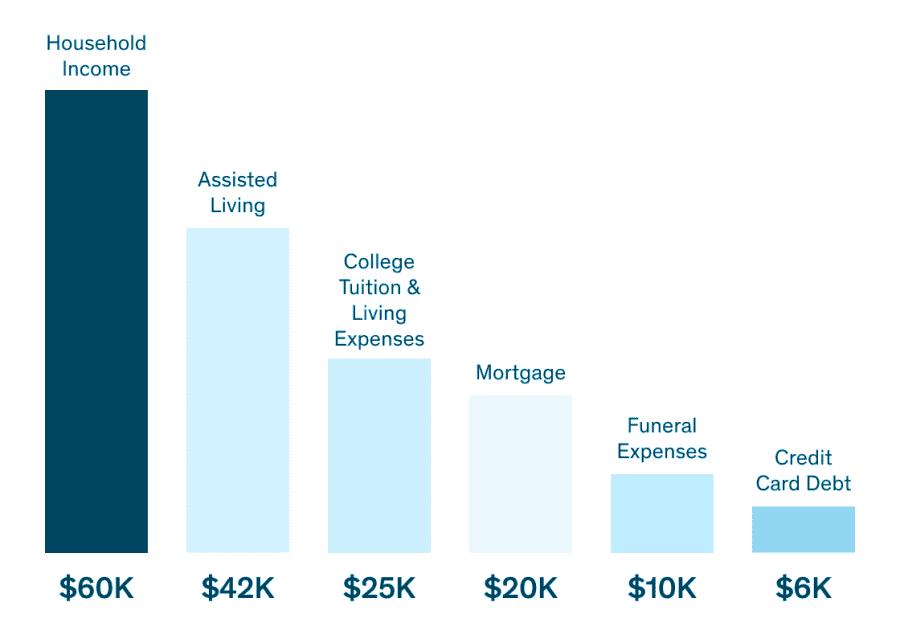

With the average U.S. household income hovering around $60,000 per year it’s important to take into account the typical living expenses life insurance payouts can cover:

- The median cost of a home in the U.S. is $200,000, which equates to annual mortgage payments of at least $20,000

- The average cost for college tuition inclusive of living expenses is about $25,000 per year.

- The average U.S. household has at least $6,000 worth of debt

- The typical cost of assisted living is $3,500 per month, which equates to $42,000 per year.

- The average cost of a funeral in the U.S. is $10,000

Typical Living Expenses

How much will it cost me?

Get an instant, personalized quote

Why Life Insurance Network?

At Life Insurance Network, we always put people before profit. We’ve redesigned the entire application process from start to finish to make it easy, accessible, and straightforward for everyone. Because protecting your family should be that simple.

Speed

Simplicity

Integrity

Flexibility

Dependability

Support

Why thousands of Americans choose Life Insurance Network

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

via TrustPilot

This was such a good experience looking…

This was such a good experience looking at insurance policy options. The experience working with the Life Insurance Network team was so simple and easy. In the end I was given options that exceeded my expectations and gave me peace of mind thay my wife is in good hands if something happened to me.

Roger H.

Take the first step

Get started in 3 simple steps

Get a quote

Before you apply, get an instant, personalized quote with several flexible policy options to choose from. You can customize your coverage amount and term length to match your needs.

Apply in minutes

Get coverage